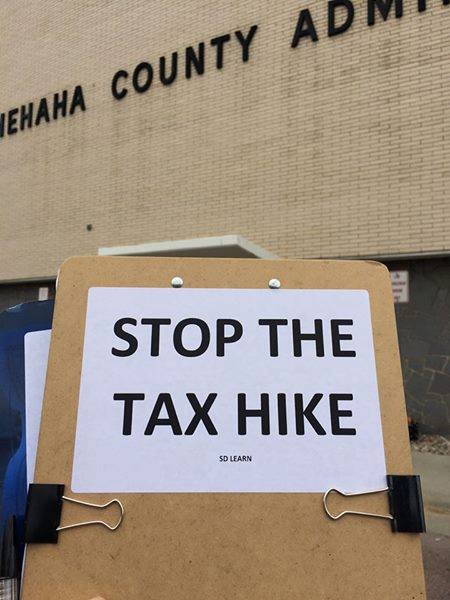

Drive through to sign the petition to put the School Board’s 50 MILLION dollar property tax hike up for a vote! We will be there all day Saturday 9 AM – 5 PM and from 1 PM to 4 PMÂ on Sunday July 2nd. Turn in the petitions you are circulating! Notary present.

Located in the same place you pay your property taxes! Parking lot of the Minnehaha county administration on Minnesota Ave and 6th Street.

Local government has become fascist. Something like this requires public acceptance and approval. Perhaps the 50 mil is required but we need specifics and give us our vote. Huether got this force feed method started by refusing the 6400 petition and vetoing the council for the 25 mil Admin Building. Should the Feds install a transitional government while there’s a return to democracy.

With all due respect, why would we want to sign this petition? As much as many of us find the sales taxes in this state to be severely regressive, would we not rather have the 1/2 penny sales tax increase be used to fund education for all of the children, then to allow parts of this 1/2 penny increase to be used as tax relief for citizens who live in expensive executive homes?

Property tax relief for the rich via an increase in our sales taxes is the ultimate form of regressiveness, while offering a better education for all, even if it comes from a sales tax increase, is at least opportunity for all and a better investment in our future…

Don’t get me wrong, I hate the idea of increasing the sales tax in this state for anything. I still believe, that in time and place, the monies for increased teacher pay could have be found without increasing the sales tax a 1/2 cent in 2016. But for us to now turn that sales tax increase into mere property tax relief, and especially tax relief for the upper income and rich in Sioux Falls School District, is to become an agent for the affluent, and to become an unwitting partner in a state tax policy which is constantly trying to find new ways to protect the rich at the expensive of the average worker and taxpayer.

Clause: I would agree – but- the Board is not saying they currently need the money. They are using the opt- out like overdraft protection on a checking account. They may draw on it, they may not. They are arguing “uncertainty” at the state and federal level makes it necessary.

If they need the money for ongoing expenses, they can ask taxpayers for an increase to cover costs. But they don’t trust taxpayers to accept the increase argument in real time, so they set up a savings account of sorts.

RV, thank you. It seems to me that these monies should go to an immediate additional increase in teacher pay and not for “overdraft protection” or for property tax relief, however.

Because isn’t this capability, which the Board is currently attempting to orchestra, a by-product of Senate amendments to HB 1182 from the 2016 legislative session? So isn’t it fair to say, that prior to those Senate amendments, these monies would have gone directly to additional teacher pay increases, but now this petition would direct these additional monies instead to tax relief, or to “overdraft protection,” if the petition drive fails, that is?

My guess is that these monies will not be used for additional teacher pay increases in either case, but that property tax relief will most likely be the end result of this entire controversy, resulting in the working poor, through their sales tax payments, helping to offer property tax relief for the affluent in our District, which I think is fundamentally wrong.

Overdraft protraction is a very good description of what this school board tax is all about. Well done

If anyone thinks the school board tax will go uncollected, your a moron.

Our laws are set up backwards. We should vote to raise taxes not vote to stop tax increases.

I agree, a $50 million dollar OPT-OUT should have been voted on. Isn’t it ironic that Morrison said we can’t vote on OPT-OUTS because we would be voting all the time, so when do they pass this opt-out? One week after a school election. Jackass statement indeed.

EC, I do agree with some of the things you are saying. I agree education is an investment in our society and economy, but for someone who doesn’t have children or plans to have children, I get really worked up when they are raising my property and sales taxes for education when we know damn well if they would eliminate certain sales tax exemptions, taxed farm land more equally and actually pulled money from the state’ education investment funds, we would have plenty for our schools. I would also like to see the teachers and administrators more evenly on a scale paid. Teachers are last while administrators are 24th. Why not make our teachers and administrators both 33rd?

l3wis, I hear ya, but your excellent points are the reason I question this petition drive to begin with…. Because, if we don’t allow the “overdraft protection” to go forward, then the political result will be property tax relief funded from an increase in the sales tax, which I think is worst. And the result of this will be a decrease in potential educational funding, that will then be experienced in the reactionary age of Trump and DeVos, which should make any proponent of education very nervous.

I totally agree with you about where the money could be found at the State level, which the Governor and Legislators are unwilling to seek, but that’s a problem regardless of what a persons position is concerning this petition drive, however.

But I do disagree with your comment about having children. Because I think a person, whether they have children or not, or still have children in the local school district or not, that none of that should matter, and that all taxpayers and/or adult citizens should be supportive of a strong and well funded school system, because we all benefit from such a reality whether it be direct or indirect.

And as far as the 24% issue, I wouldn’t cut administrative pay, rather I would support moving teachers towards the 24th position instead. Because the one thing that low teacher pay does among many is that it causes higher teacher turn-over. So you need well paid and competent administrators to handle this reality with as much support and thus resolve as possible.

I believe that this struggle over this issue has led to an interesting group of political bedfellows from the Right and Left in our community, but I am afraid that if this petition drive succeeds, that the Right will get the better hand in this manner, however. The Right merely wants to cut taxes with crocodile tears when it comes to education, while the Left is driven, in my opinion, by a distain for the establishment or the Board. And if the petition drive succeeds, the Right will be richer and the Left will be unknowingly complicit in making our children or students even poorer.

No doubt, if the Board from day one would have taken this issue to the voters, that the Board would have lost. But that does not mean, that the Board’s intentions on this manner are not right, nor does it mean that some of us who are often critical of the establishment, especially on this blog site, should think we are now right just because we have an opportunity to challenge the Board, when really such a challenge will only make us unwitting agents of the Right and their true agenda, in my opinion….

We already have the regressive video lottery in this state

funding property tax relief. So let us not continue this regressive bent by now using our regressive sales tax system in a direct or overt manner to also fund property tax relief as well….

teacher pay is last, while administrator pay is 24th? that’s called “running government like a business”.

EC says,

Because, if we don’t allow the “overdraft protection†to go forward, then the political result will be property tax relief funded from an increase in the sales tax, which I think is worst.

No increase in sales tax can happen without a Public Vote.

After what has transpired in the short period of time since the 1/2 cent sales tax increase, do you really believe the public is in the mood to talk sales tax increases anytime in the near future? I highly doubt it.

I hope this petition drive is successful. My vote will be a resounding ‘NO’ to the 50 million!

anonymous,

I was referring to the past 1/2 increase and not an additional increase.

Using sales taxes to pay for property tax relief is to be on the wrong side of history, in my opinion….