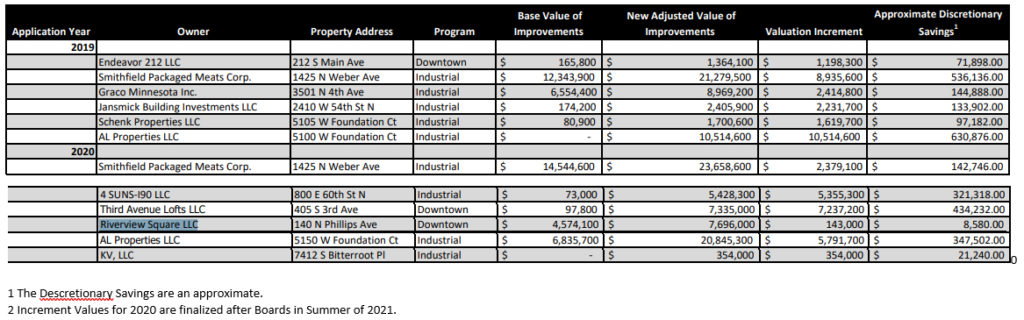

We found out a few years ago that the Planning Department in collusion with the Mayor’s office has a list of PRIVATE developer and corporation tax rebates. The kicker is all of the rebates are approved ONLY by the discretion of the Mayor. There is NO City Council OR public review of the rebates. The mayor simply signs off on them. While they can be seen by the public you have to know who to ask. There are NO public presentations of the recipients.

How do they work? Basically a developer or company, or investment group (LLC) makes significant upgrades to the property and a portion of the cost (usually around half) is rebated back to them from their paid property taxes. Like TIFs, it is only an option for a select few and extremely UNFAIR to the 99.99% of property taxpayers in the community.

Now, I’m not going to cry corruption, I’m just going to keep this simple, it is time to end this welfare handout because 1) it goes against the FREE market system but more importantly 2) The mayor should not have this kind of power and control to secretly hand out tax rebates to whomever he wants to.

I think the City Council needs to end this process ASAP.

You will see below how random and highly questionable the recipient list is which adds the element of corruption;

• Endeavor 212 LLC, Dr. Richard Brue, Historic DTSF Property, this one surprises me since downtown property is very valuable and certainly doesn’t need a tax break.

• Smithfield, this company owned by Communist Chinese investors got a massive tax break in 2019 and again in 2020.

• Graco Minnesota Inc, this very successful company based out of Minnesota got a tax break. Why?

• Schenk Properties LLC and AL Properties LLC may be intertwined with Murray properties and they have gotten massive tax breaks in Foundation Park for 3 different properties in 2019 & 2020.

• 4 Suns-I90 LLC, I believe has developed property on North Cliff and 60th, they are based out of Fargo, ND. So I guess we don’t only give tax cuts to the Chinese but also our Northern neighbors.

Third Avenue Lofts LLC, Riverview Square LLC are Legacy Projects intertwined with Norm Drake. So I guess the mayor felt it was okay to give a tax break to a guy involved with the Copper Lounge collapse and the Bunker Ramp debacle.

KV LLC, this one is a mystery, but seem to be based out of Sioux City, SD.