Real Classy South Dakota

Okay, so the state department of revenue just chooses to ignore a state law for decades (instead of just telling the legislature to fix it) Then all of sudden decides they must enforce it? Then says if you want to skirt the law, you can go thru a complicated application process for something you may do a couple of times a year? Then, the kicker, since they can’t tax people who receive free food (from food banks and churches) they have to tax the food these orgs are giving away? WOW! Talk about having to pay extra for a undercooked shit sandwich;

About 275 organizations statewide that give away food to needy people might be forced to pay a long-unenforced sales tax, prompting some to worry the agencies simply will stop providing food to the poor.

At issue is a handling fee that agencies pay to the organization that supplies them with food.

A state law outlining the taxes has been on the books for decades. But it wasn’t until late last year that an audit discovered the maintenance fees existed and needed to be taxed, said Jan Talley, director of the state’s Business Tax Division.

“We are charged with enforcing the statutes of South Dakota,” she said.

Your charged with enforcing a law that you haven’t enforced for decades? So instead of just getting the powers of be to fix it, you have to be the assmunch instead and enforce it? Seriously?! Pierre is freaking broken, and this is further proof.

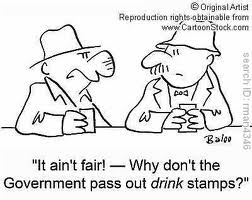

But the best part is the Argue Endorser’s online poll today;

I would like to meet these clowns that think it is okay to tax orgs that give food to the needy. I have a sandwich I would like to feed them. And it’s not made of turds.