What does L & C water system have to do w/Sales Tax? NOTHING!

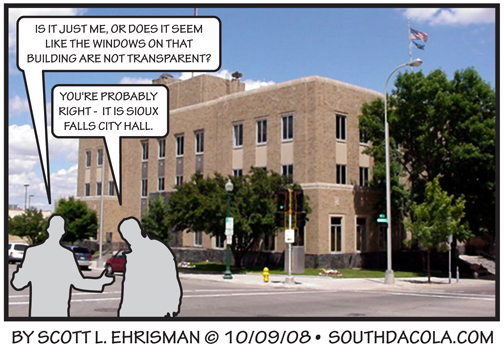

Mayor Munson seems to be up in arms over the sales tax decrease initiative (Argus Leader), which is no surprise, well it kinda is. It will have NO EFFECT on his budget and will have to be dealt with by the next mayor and council. By the time this takes effect, there will be at least 3 to 5 new councilors and a new mayor. Secondly Munson seems to be spinning the story,

Munson bristled at accusations that he hasn’t overseen responsible growth during his time at the helm, pointing to major street construction projects on 57th and 26th streets as recent examples.

“We planned Lewis & Clark for growth,” he said, referring to the water project. “Maybe under their scenario we don’t need Lewis & Clark. I think that’s crazy.”

First off, this decrease won’t take ANY money away from street construction (I’ll get to that later) and secondly Lewis & Clark is being paid by a loan the city took out that is being paid off from increased water rates, not sales tax. We also may receive money from the Federal Government (don’t hold your breath though, it seems neither presidential candidate is too interested in that). Like Rudy Guilliani and 9/11 everytime someone wants to cut the budget, Dave brings up Lewis & Clark. Cut the bull Dave.

As for street construction money being taken away, this is also a myth;

Officials warn that Sioux Falls will continue to lag on new road construction if the tax doesn’t go to a full cent. That, in turn, would hurt economic growth at a time when the national economy already is in precarious shape.Officials warn that Sioux Falls will continue to lag on new road construction if the tax doesn’t go to a full cent. That, in turn, would hurt economic growth at a time when the national economy already is in precarious shape.

It is merely $5 million dollars that will have to be cut from the Capital Improvement Budget (Basically a slush fund that pays for all the goodies (wants)Â in our city). In fact Munson mentions a great cut in the article.

Munson pointed out that McKennan Park next year is budgeted to receive $615,800 for upgrades.

Huh?! They just received upgrades this year already. Another example of wasteful spending.

And it seems councilor Costello went over to the dark side,

“They are fully within their rights to do what they are doing,” Costello added. “I personally would not sign that petition.”

Why wouldn’t you sign it Pat? I sign petitions all the time with stuff I don’t agree with. I signed the Initiative 11 petition, I signed Nader’s and Bob Barr’s petition to be on the ballot in South Dakota. I think it’s good to let the citizens decide. This is what a democracy is about. Do we want to let citizens decide on what they want to spend $5 million dollars on, or do we want 4 councilors, developers, special interests and a mayor decide?

I think we know the answer to that question.