Fellow South Dakota bloggers BOTH make strong arguments in which I partially agree. (If you go to Ken’s story first there is a link to Cory’s post).

I have often said instead of beating our heads against the wall over who is to blame it can be summed up in one word; GREED. Lot’s of greedy people twisting politician’s balls.

You could probably trace the start of the problem all the way back to the Reagan administration. Deficit spending is never a good idea (Hope you are listening Dave Munson).

But it seems all trails lead to five guys;

I’m just going to summarize their roles and you can google and such to fill in the blanks.

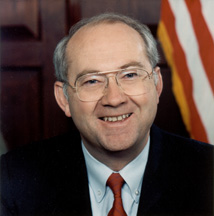

Just one of the greedy assholes who f’d up our economy

PHIL GRAMM

– In 1999 dissolved the 1933 Glass-Steagall Act (The act limited different investment companies from merging so if one house of cards fell, they didn’t all fall).

– In 2000 he snuck risky, non-regulated ‘derivatives’ in a 11,000 page appropriations bill that Bill Clinton signed (and apparently did not read- think pre-war Iraq intelligence report).

ALAN GREENSPAN

– As fed Reserve Chair from 1987-2006 he prevented anyone from touching ‘derivatives’ swearing by them (you have to remember Alan idolizes Libertarian Novelist Ayn Rand) even though there was warnings from these guys (you might have heard some of their names); George Soros said he wouldn’t invest in them because he “We don’t really understand how they work.” Investment Banker Felix Rohatyn described them as “Hydrogen Bombs” and back in 2003 Warren Buffet called them “Weapons of mass destruction that will be lethal to our economy” (he must of had a crystal ball).

CHRIS COX

– As SEC chair he eliminated the office that investigates ‘derivative’ problems. It’s kind of like telling cops and citizen watchdog groups not to worry about where sex offenders live, they should be fine watching themselves.

HENRY PAULSON

– Hands bailout money over to the same people who caused this crash. What did Henry do before he got his current job you ask? He was a ‘derivative’ expert that made his employers billions on the crappy pieces of paper. His last paycheck the year before he went to work for Shrub was $37 million.

WILLIAM DONALDSON

– In 2004 when he was still an investment banker and dating Henry Paulson (Ha-Ha) he asked the SEC to remove a tiny little rule. Banks wanted to remove a rule that forced them to keep sizable amounts of money on hand for potential losses (kind of an insurance policy for banks if they run into trouble, and prevents the government (us) from bailing them out if they do). William argued they should be able to invest that money, and the SEC unanimously agreed. Guess where they invested the money? Yup, Derivatives.

There you have it kiddies. It wasn’t poor minorities wanting to buy houses next door to you that caused this problem it was greed. I say when Barry closes Gitmo, we make it a nice permanent vacation spot for these guys. Hope they like Barney and Metallica.

So many Aholes, so little time.

I agree, mortgages had a part to play in this, but when you sell pieces of paper that are just that, pieces of paper, for billions, you have to ask yourself – WTF were they thinking?

GREED.

[…] As I mentioned in a post in December, a couple of guys stood out Gramm and Cox. […]