As the city council discussed giving $10 million towards the DSU Cyber project tonight and after watching the presentations and seeing the state supports this, I think it is a good project. Not sure I believe all the bull thrown about today, but it is a positive investment. I did shake my head though when the Dean of DSU was talking about what the $10 million investment in infrastructure was for and said something like, “It’s for campus lights and sidewalks, but we don’t know what that will cost since the final plans haven’t been drawn up yet.” So where did the $10 million number come from?

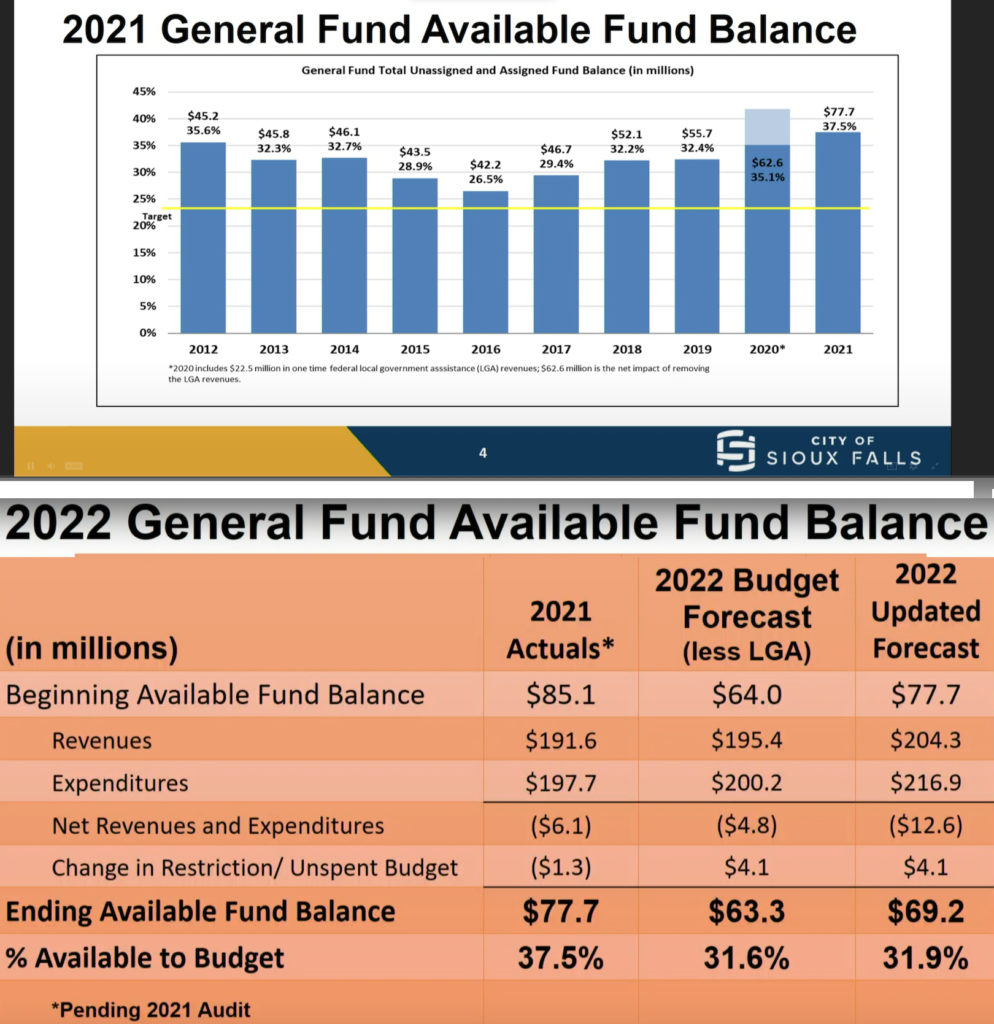

But what shocked me was these slides presented by the city finance director. Fortunately I took a screenshot, because these slides are NOT available online. The city has millions laying around in the reserve funds.

It is unfortunate the council was not told this last month so they could come up with projects (like cleaning up our core, or even better, CUTTING PROPERTY TAXES FOR ALL OF US! Instead the mayor, who hates transparency, hid the information from the council so he could push his pet projects, so far spending $12.5 million of it, with NO input from council except a vote once it was packaged in a neat little bow.

Whether you agree or disagree with the bonuses or the cyber project is of little concern, it is how the mayor secretly negotiated these projects that is very bad for good government.

Spot on with your analysis on this issue. As the city hands bonus checks and throws away money on ice rinks, ski hills (that are NEVER open), the Washington Pavilion (go once and you’ll never go back) the State Theater (yes, it still smells musty) Golden Girls puppet Shows at the Orpheum…you get the picture. Waste, waste, waste. For a few blowhards that can say Pew, pew…we are so chic. Wake up Sioux Falls! Let’s work on lowering sales/property taxes. When is the last time your utility bills went down!? Last time I posted this, some treehugger gleefully proclaimed…”my propertytax went down”. I’m guessing he saw a unicorn too

As fuel heads toward 5 per gallon, with 7-10 dollars possible, the city is going to regret spending so wastefully. A reckoning is coming.

My property taxes did go down this year, but then I got a 28%+ assessment increase in the mail shortly after. I guess we will see what happens next year, huh? Why aren’t the candidates talking about the assessments? They will be in the 2023 and 24 elections cycles, or will be forced to at least.

Gas prices will probably mean more bike trail usage. And Barney Fife will be clocking your speeds on it….. Beware!!

And yet, Minnehaha County and Lincoln County struggle to fulfill legitimate, constitutionally defined roles of government (roads, bridges, transportation, law enforcement and care of the indigent).

Here is one for the legislature: re-align the taxing authority for sales taxes which are currently collected.

Assign an interval of 0.5% (or more) of the current sales tax levy authority to counties; rework (reduce) the authority of municipalities to levy sales taxes by that same interval. Because of existing bond obligations and covenants associated with municipal debt, might need to maintain “the second penny” as a penny (1%).

For example, 2% local sales tax could be 1.5% to Cities and Municipalities and 0.5% to County government.

The City of Sioux Falls has been granted increasing sales tax authority over the recent past history. Frankly, the City of Sioux Falls, the Mayor(s) and City Councilors have proven to be an extremely poor stewards of tax receipts.

There will be squealing. There will be weeping and gnashing of teeth. But Boom Town can live on less sales tax revenue, because … well, it’s Boom Town.

Supposedly taxes are divided among levels of government. How about steer more toward the county with less to the city? Maybe build a new jail the county provides but the city uses. None of the pleasure palaces are profitable. They’re a drain that’s ongoing into future budgets. Strong Arm Charter has become an unregulated mayor gifting his buddies with TIF’s. All hail king TenPoops.

I see Erickson and Kiley were AWOL last night. We are still paying them to finish out the final two months of their terms, correct?

State Statute’s bar cities from raising their Sale Tax Rates past the 2.00% rate. The City of Sioux Falls manages this by adopting a tax policy of 1.00% for general government which includes existing street maintenance, while they adopt a second 1.00% sales tax rate (second penny) for New Roads, Infrastructure, Public Utilities etc. The problem, we do not use the 2nd Penny as intended, up until 2017, we borrowed the money, while pledging the 2nd Penny to pay off the loans.

How many people know that the city only collects $380,000,000 in total taxes? While $250,000,000 come from other sources?

The City continues to grab more and more “revenues” from OTHER SOURCES, while projecting higher than normal cost estimates for future projects, which creates a surplus, while at the same time, continues to collect $380,000,000 in ‘taxes’.

And the Sales Tax and Property Tax go up based on continued ‘population growth’. The average resident pays $690 a year in sales tax to the city, do the math, as the populaiton goes up so does the tax.

Where did they find the $10,000,000 million in funds? from “other sources of revenue” which allow us to avoid using the Sales Tax Funds themselves.

Lets not forget – The City of Sioux Falls has a Net Position of $2,000,000,000 billion dollars after it pays off all expenses, liabilities, debts, and obligations.

Los Angeles and Minneapolis have a “Negative” Net Position”

Where does Sioux Falls gain its wealth? I mean, they hold ‘ownership’ to Land, Real Property, Infrastructure, etc.

The Public Parking Ramp = ASSET on the books. More assets = more leverage to borrow money.

More “Residents” = more federal and state grants.

I agree – CUT the Sale Tax Rate from 2.00% down to 1.50% by trimming the 2nd Penny by half. Cant go more than that, thanks to the DEBT pledged to the tax.

Relative to collection and distribution of sales tax revenue, I find myself simultaneously in sympatico with D@ily Spin.

Wierd!

Someone tell me how to feel about this.