A gentleman tonight during public input at the City Council meeting put this graphic up on the overhead during his presentation. I was disappointed he ran out of time before he started to address TIFs. I should recruit him to write for my blog.

A gentleman tonight during public input at the City Council meeting put this graphic up on the overhead during his presentation. I was disappointed he ran out of time before he started to address TIFs. I should recruit him to write for my blog.

Comments are closed.

When are you announcing your candidacy? You are clearly of the mindset that you’d be much better than any mayor in the history of Sioux Falls.

LOL. I would be a horrible mayor, and you know it. I also wouldn’t want to sit on a council or legislature where I would essentially be powerless to make change.

Besides, where did I mention the mayor in this post? This is about taxes and fees, something that falls under the responsibility of the city council.

wow, those are high taxes. no wonder craig lloyd needs a tif.

Oh, I’m well aware. I am not sure you are though. To me, you come across as someone who thinks he could do better. I’ve been reading this blog off and on for years, and can really only remember a handful of times you’ve been complimentary to anyone besides Stehly or someone who just died.

Say Unstable, who did you support for mayor in 2018?

UG – This is blog is called SouthDacola, a blog that is critical of local government. It is not called, ‘Positively Keloland’ or the ‘Siouxperhero blog’.

I didn’t vote for anyone last city election. I can’t, I live just outside the city limits. Also, I probably dislike KELO TV more than you. Could you maybe admit that the current mayor is better than the one you so professionally called Bowlcut?

He’s better in the sense that he doesn’t hold a press conference every time he takes a crap, but when he does, it would be nice if he did it in front of journalists and members of the public instead of in his garage. I also like it that he doesn’t wear a tie, who cares. But I’m not sure what to think of his half-mohawk haircut? If you are going to get a mohawk, go all the way bro.

“Hey, man. What’s up. Your haircut looks like ass. Man up, bru.”

“I think it’s a movement among conservatives”….”Some wear a ‘half-mohawk,’ whiles others do that Trump thing, but together they are a full head of hair”…. #HalfThere

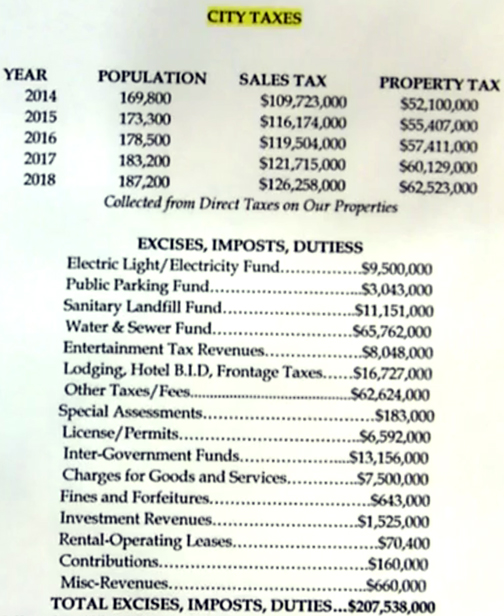

So, sales tax revenue has gone up 15%, since 2014, while the population only went up 10%; and property tax revenues went up 20%, since 2014, while the population only went up 10%. With numbers like that, shouldn’t our tax burden be going down? And how much of that 20% increase in property tax revenue is coming from the fact that median priced homes have skyrocketed in price in recent years, because of demand and because contractors are only building executive homes?

( and Woodstock adds: “Say, maybe this whole ‘Culture Officer’ thing is a good idea, because at the current rate, I don’t think we are going to be able to afford the current ‘Culture’ for much longer”….)

I was unaware of the law or ordinance that requires contractors to build certain types of homes. Should vsg want something other than executive homes I think he could probably build them. Maybe, as he is a genius, he could figure out how to do that a lower price also.

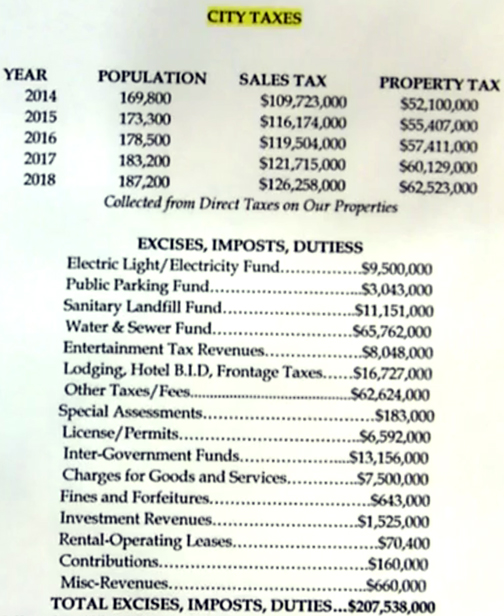

I am the guy who spoke – my goal was to show people just all the taxes that citizens of Sioux Falls pay in 12 months. You can access the same information I have in the 2018 C.A.F.R online or purchase a hard copy from the Finance Department. Quite interesting when you look at the real numbers, statistics, and information. All public info. We have nearly $2 billion in net assets as a city.

(this is the speech I attempted to give during public input at the 12/17/2019 Sioux Falls City Council Meeting, the very first speech I ever made, with many more to follow as I begin to get more comfortable with public speeches)…………

We are very fortunate to be residing in a State where we are enjoying not only an economic boom, but we are also enjoying a population boom. According to the City’s own financial reports, we grow by an average of 3,000 to 4,500 residents per year. Those Residents are responsible for providing the City all of its revenue in many form of taxes. While it is nice to create such a strong tax base, however, we keep raising the rates of our “user fees” to support and invest in our enterprise funds. A look at the enterprise funds – shows we are creating huge profits, which makes them not only self sufficient, but we are generating the much needed revenues needed to invest back into the funds themselves. I feel its time we discuss giving the ‘residents’ a tax break for the first time since 2005-09. Remember – that’s when we lowered our sales tax rate to 1.92%. The reason we increased it was to raise additional revenues to invest in our capital assets, the very assets today that are being well funded by ‘user fees’. We are in a much better position today than we were 10 years ago, and I say, its time we give the citizens a much needed break. I lobby this council body to lower our sales tax rate to 1.75%, just a 12% cut in revenue. Allow the citizens to keep $0.25 cents of each dollar they spend, allowing them to invest back into their properties, perhaps even spending more income on goods and services, which will increase our sales tax revenue. I say cut the first penny while keeping the 2nd penny at 1.00% to ensure we keep investing in capital assets, all the while we cut the general administration slightly, to let alone we place a greater emphasis on our “user based” enterprise funds thus paying them as we ‘consume them’. A brief look at our population and sales tax trends – this will not take away any previous revenues, in fact, the revenue increases as the population grows. We give “Land owners/developers” property tax reliefs thru the T.I.F Program, but why not give the entire population via “Sales Tax Relief”. In closing – I project over a five (5) year period (2021-2025) even with a lower sales tax rate – we will generate $130 to $140,000,000 million per year in sales tax. Folks – that is an increase in revenue even with a small cut in our rate. I urge this council body to create this positive discussion, and give the Citizens of Sioux Falls a much needed break from our direct taxes on property.

Thank You,

Mike Zitterich

(Sioux Falls)

VSG – Sales tax increases can be attributed to more people form out-of-town shopping here as well as those who do live here having more to spend and spending it. (Thanks Obama for saving the US economy). I can attest to the amount of spending that is done by folks from quite a great distance away as I delivered goods from a large retailer to folks as much as 100 miles away for several years. Trust me – it’s a LOT of $$.

Likewise – property taxes (as a gross amount) are based not on a percentage increase in the tax RATE, but are in direct proportion to the value of the properties taxed. One can only conclude more properties of a higher value are being built by those folks moving in vs. those who are hunkered down.

MJ, you are correct, they should not tell contractors what kind of houses they can build, as long as they are following building regs. This is my main issue with Tifs, while developer gets to pretty much build what they want to, without limitations, why should they get a tax rebate?

Correct – Sales Tax is paid by anyone who purchases real and tangible property in Sioux Falls. It is in fact a ‘direct tax’ on property agreed to by the “We the People” of South Dakota. There are two ways to promote the City of Sioux Falls – 1) The City itself thru marketing activities, as well as by 2) We the People of Sioux Falls by attracting their Family, Friends, Associates from Out of State. The more we work together as one, promoting the City, the more revenue we can create. Those tourists are not only paying our sales taxes, they are paying the 3rd Penny Sales Tax assessed on Food, Entertainment, Hotel/Lodging, Public Parking Fees, etc.

I have never been a huge fan at providing Tax Subsidies, Credits, Benefits to the people. To me, if we have money for that, then our tax rates are way to high to begin with. But if we give Land Owers/Developers ‘breaks’ on Property Tax Contributions, then should we not give the entire “city” a break on Sales Tax Contributions, make the entire ‘city’ a T.I.F District for example.

Another thing we must realize also – with the State amending our Sales/Use Tax laws in 2017 forcing “Foreign Retailers” to collect our sales tax when they do business with 200 State Citizens or $200,000 in gross sales inside our borders, we will collect more and more sales tax in the future as more people shop online.

And one more asspect of “Sales Tax” that most people do not realize, when you shop outside our borders such as traveling in Minnesota, Iowa, Nebraska, you really do NOT owe sales tax in those states, cause you travel as a domestic foreigner, not bound to pay their ‘direct taxes. So as more people understand our laws, they should exempt themselves from Minnesota ‘sales tax” then report that transaction to Pierre as a “use tax”. This part of the law goes unnoticed.

But one thing you should all keep track of, is our “enterprise funds”. They all carry huge balances in their bank accounts. They are showing profits cause the “Fees” or shall I say “Duties’ are being raised to invest more money in the Enterprises. This is a good thing, as we do not use “sales tax” to fund them. BUT – that only makes my argument to lower the sales tax rate on the “whole people” of the City. I myself would rather pay 1% sales tax on my purchases, and a higher ‘user tax rate” on a service for quality service. But then again, we do need to balance the two types of taxes, cause then the ‘user fees’ can hurt those whom need the service.

This is turning into an interesting discussion…

rufusx,

But with brick and mortar taking a continual hit, I question the true out-of-town growth, but regardless, its all relative, with sales tax growth superseding population growth. In fact, if there is any growth, isn’t it mostly online growth, where you then deliver, which means there is no collateral growth since the out-of-town consumer never graces Sioux Falls?

As far as the property tax issue, you have just restated my point, that hyper-inflation with median priced homes has contributed to the property tax revenue gain for the most part.

But with all of this tax growth superseding population growth you would think that would put us in a situation where there are more than enough tax dollars to get the job done and possibly a rebate would then be, in order, too.