UPDATE II: The FIX is in on property taxes

UPDATE II: I went and talked to the equalization department today. After reviewing the increase, they explained to me that 90% of the increase is land value, in which is formulated different now. We also calculated that my taxes will probably go up $250 dollars next year, which is NOT $2 a month, just for the record.

UPDATE: I decided to go back and look at the records I could find

From 2008-2009 the value of my home went up 1.8%

From 2009-2012 the value of my home went up 0%

From 2012-2016 the value of my home went up 10% (aprox 2.5% per year)

From 2016-2017 the value of my home went up 1.8%

From 2017-2018 the value of my home went up 1.8%

From 2018-2019 the value of my home went up 2.3%

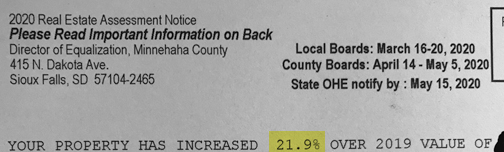

From 2019-2020 the value of my home went up 21.9%

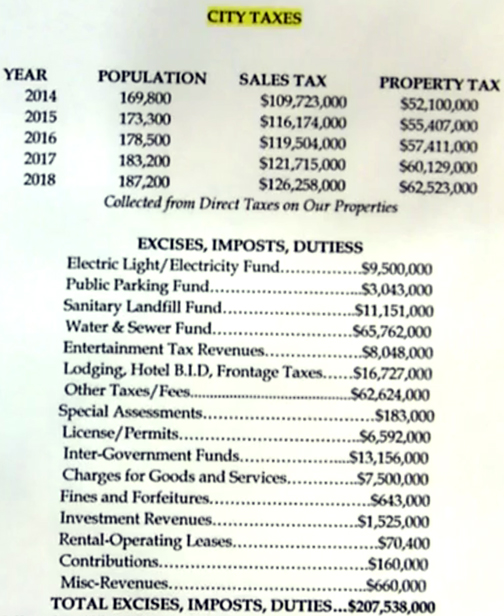

As I predicted and warned people, the school bond, the new county jail and the multiple TIFs we hand out are going to catch up with us. The $2 a month boloney they pitched us was a farce, because I knew they were going to make hay with the assessments. And sure enough they did.

My increased assessments year after year have been steady, but reasonable. I have owned my home for 17+ years and my property taxes have doubled in that time.

I have done little upgrades to my home, except replacing windows, doors, adding new rain gutters a privacy fence and re-shingling after storm damage. I have done NO upgrades to the interior of my house.

So imagine my surprise when I got this in the mail yesterday;

Well, I was NOT surprised, I saw this coming like a freight train. We can’t keep borrowing money in Sioux Falls and not have a way to pay those bonds, so they bleed it out of us through back door tricks like assessments. Can I afford a 21.9% increase in my assessed value? I suppose, but it also means a lot less money in my pocket.

It was interesting listening to the State Legislators talk yesterday at the legislative coffee about state funding of education. Two Republicans made great points;

• The state gives the districts money and the districts decide how that money is spent (salaries, etc.).

• Administrator pay in SD ranks at 15th while teacher pay is at 49th. I haven’t checked that stat, but I know at one time in was around 22nd. There is a obvious disparity.

• Low voter turnout at school elections. The past school bond and school board elections both had around a 4% turnout. Basically the legislator was saying, if you want to have a say on how your local district is being funded, maybe you should show up and vote in these elections. AMEN Brother! But I also have to add their is voter suppression when you use super precincts, no precincts in the northern part of our city and have district finance department employees ‘hand count’ votes, while the business director puts those counts into the system without oversight.

Who knew that owning a house that was built in 1889 could increase in value by almost 22% in one year? Not bad for a home that is 131 years old. What a joke.