Top Down approach to affordable housing is a ruse

Ever since the Reagan administration introduced trickle-down economics governments across our country have experimented with it. It simply doesn’t work. The concept is that if you give tax breaks to the very top it somehow will help the ones below in better jobs and housing. In fact it has done the opposite, expanding the wealth gap.

The cat was let out of the bag during this interview yesterday that the TIF sponsored housing development in SW Brandon was depending on the tired old broken system of trickle-down;

Meanwhile, Karl Fulmer, the executive director of Affordable Housing Solutions in Sioux Falls, told DNN that these TIF-paid city developments are an effective way of addressing affordable housing.

“The benefit of just building more houses in the $250,000 to $400,000 range still provides the unit, and you can see the transition out of more affordable units from those who might make enough to buy homes in that price range”, Fulmer said.

In other words, these new houses in new “accessible housing” developments actually are not for those most struggling to find affordable housing the most. They are far those who bought smaller, older “starter houses” in town that cost less than $250,000 and are ready to move out of them.

The true affordable housing comes in those starter houses. And the more new “accessible” houses funded by city TIFs that are built, the more those older, smaller houses become available to lower income people.

[insert laughter]

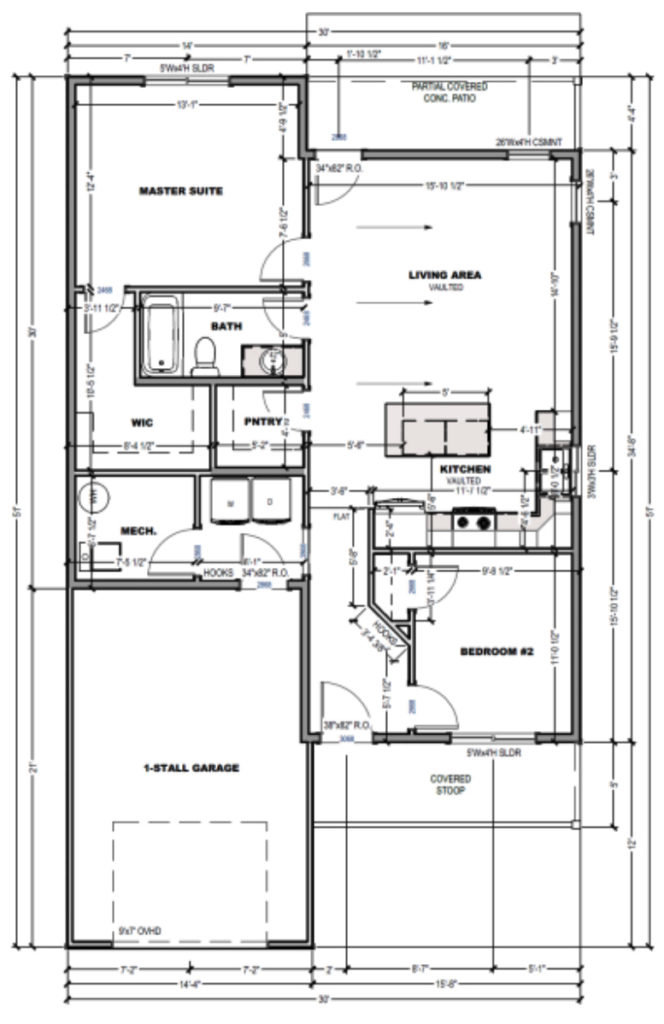

If you speak with anyone in the real estate business they will tell you that these homes are usually owned by lower income people, families, retired folks or rental property, they are not the Jeffersons moving on up. And even if what he was saying was true, most of the homes being sold in this development will go to NEW homeowners not people looking for a step up. In fact, I have argued that many of the starter homes in the lower price range (mostly in the core of the city) have more square feet and bigger yards (and basements) than what these new homes will have.

A better approach would be addressing the housing crisis we have with the people who are having the crisis;

Pat Starr, who represents the northeast district, also told Dakota News Now on Monday that city government is continuing to “dig a hole” by continuing to dig literal holes to build homes partly funded in part by Tax Increment Financing (TIFs).

“We need to talk about the real causes of the housing issues in our city rather than trying to put a band-aid and build 65 houses, which is what this program will do.” Starr said.”

“It’s not the program I’m concerned as much about as as I am figuring out who we’re trying to help. And, it seems to me we have a wage issue more than we have a housing issue.”

We must be giving a helping hand to those who are at the bottom first to lift the other boats. The city has decades long programs in place including low interest Community Development loans and grants. We also need to upgrade the existing infrastructure in our core such as streets and lighting. We can do all this using existing money in our 2nd penny and Federal dollars.

The president of Sioux Metro Growth Alliance, which helps people with payment on houses in rural and suburban communities surrounding Sioux Falls, disagrees.

“If you look at wage growth around the country and in the Sioux Falls market in the last three years, it’s been astronomical,” Jesse Fonkert said.

While wages have increased in SF, inflation and housing costs have been beyond astronomical and have wiped away any wage increases.

But Fonkert does agree with Starr’s assessment that continuing these city-funded housing projects is not solving the affordable housing crisis.

“It’s a challenging situation, because if you spend too much money on government programming, you’ll have companies that will just hike their prices up,” Fonkert said.

Notice the Sioux Steel District and Cherapa II projects didn’t announce they were building hundreds of units of affordable housing after receiving a combined TIF payout of $50 million. Developers will always go where the money is, and that is how a FREE market system works. But tax rebates for parking ramps attached to condos isn’t fixing anything it’s just making that wealth gap larger.