Sioux Falls has had ZERO sales tax growth over the past 7 months

I have not learned much from Shawn ‘Fireball’ Pritchett’s finance reports over the years, and yesterday’s wasn’t much different. Before he started his presentation he said he was presenting them finance numbers from September instead of October because the state hasn’t released the October numbers yet because of the government shutdown. Not sure why our state revenue department would have trouble creating financial reports about state collected taxes during a Federal shutdown? It would be like our state DMV shutting down due to the government shutdown, which didn’t happen because it is a state agency. Either way, they did release the October numbers, yesterday.

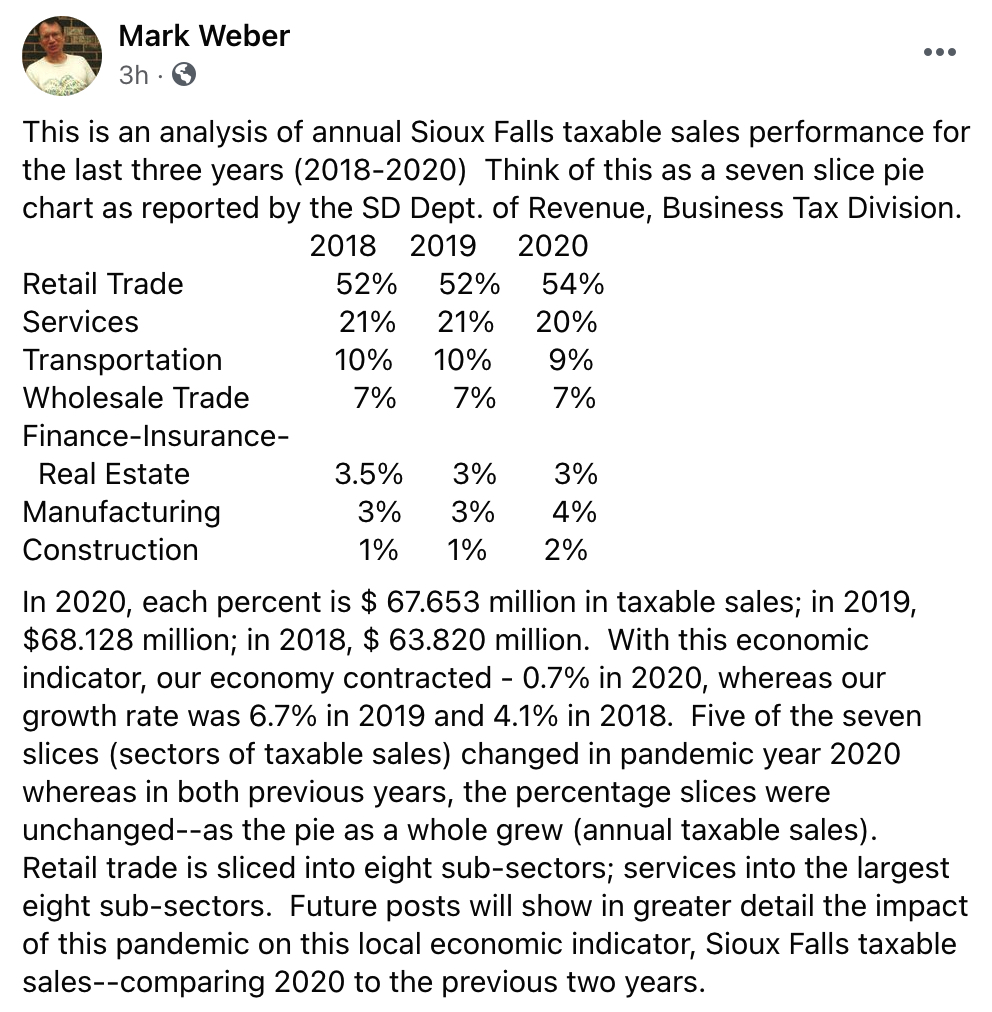

A local economist, Mark Weber, comes to the finance report meetings every couple of months and gives the council his version of the financial report he puts together by using the state data. He included the October numbers in his report (FF: 57:45). The council was so intrigued by his report they let him go almost a minute over his time (tsk, tsk – don’t let Poops catch you giving away free seconds).

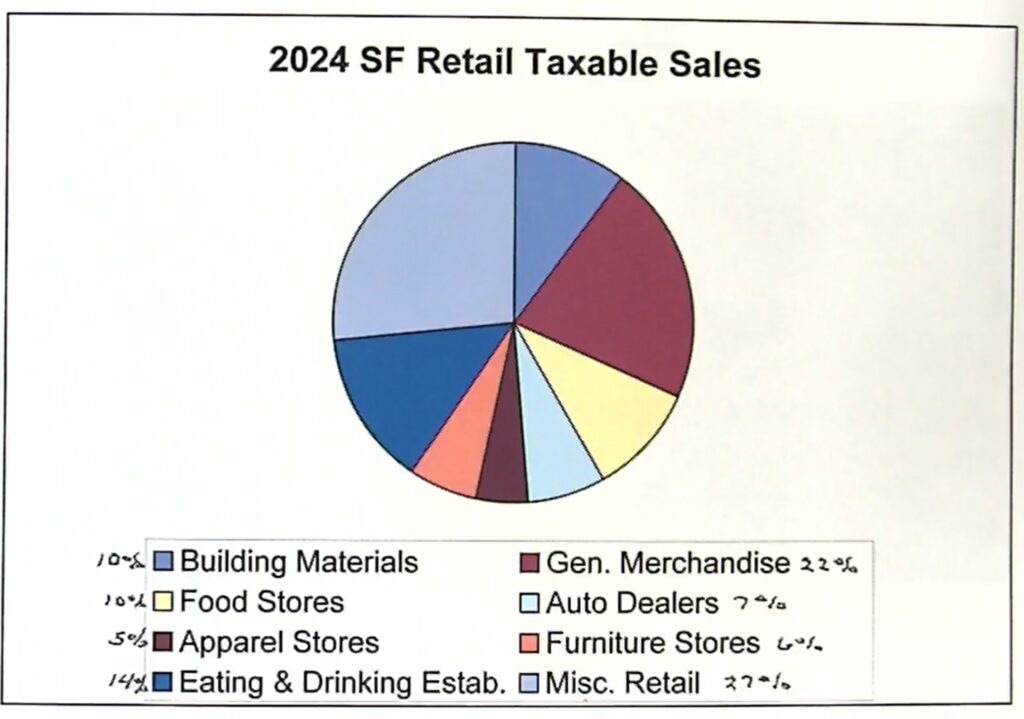

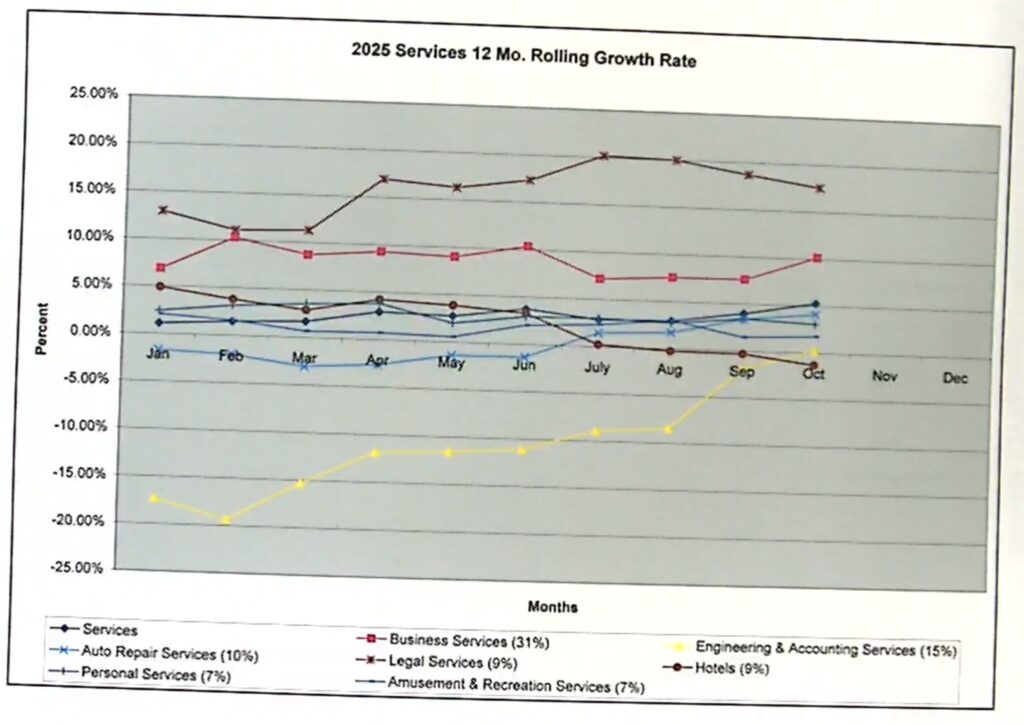

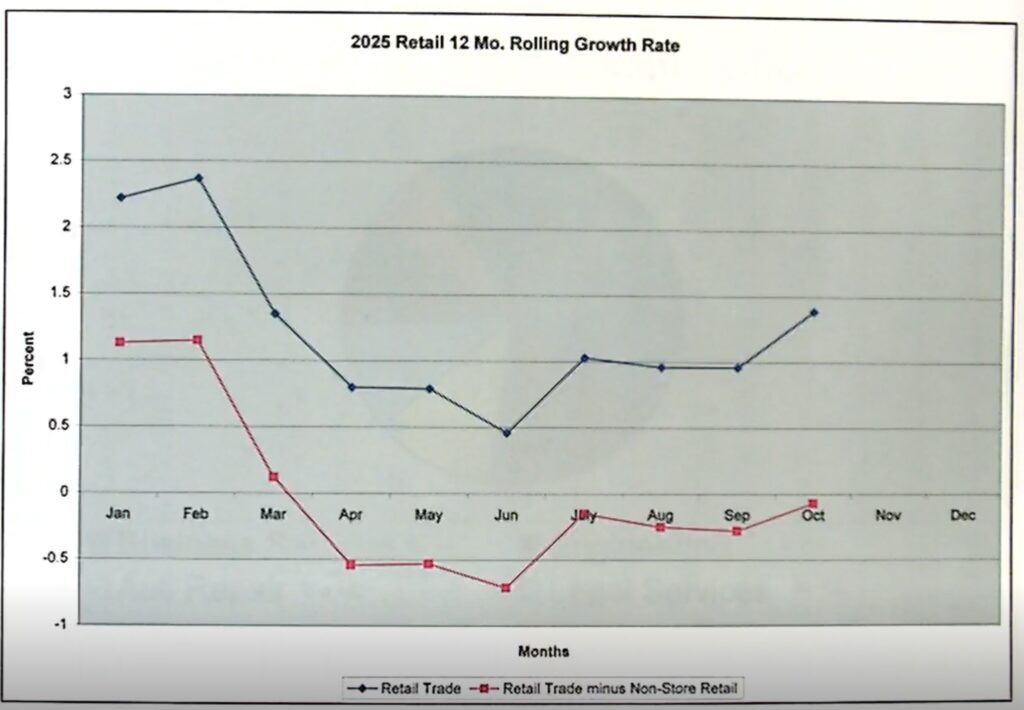

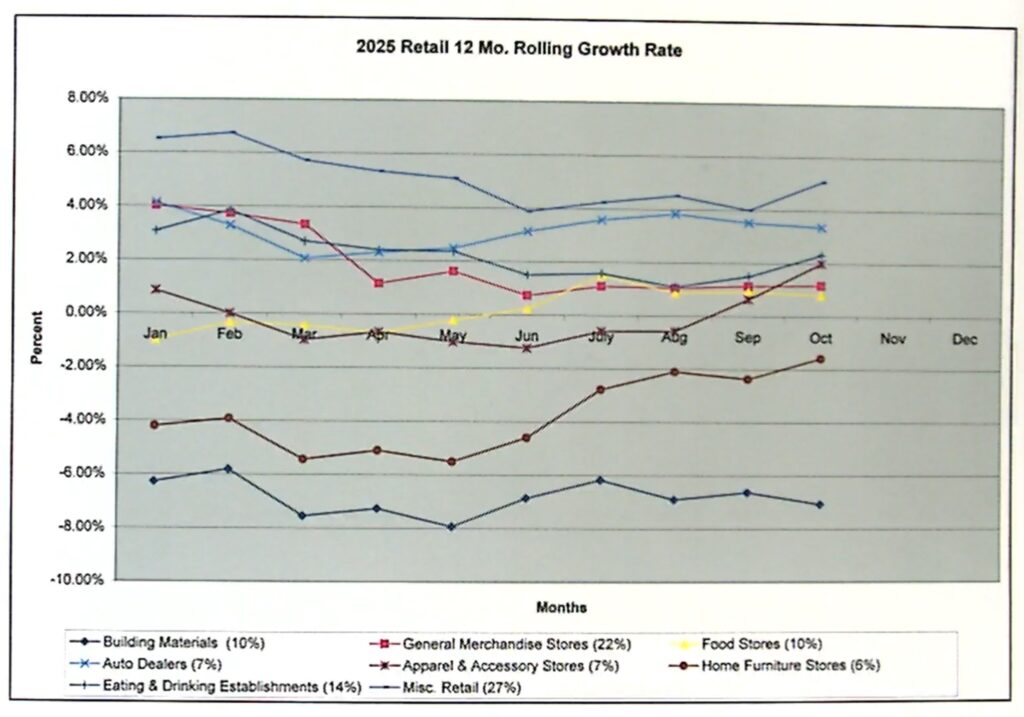

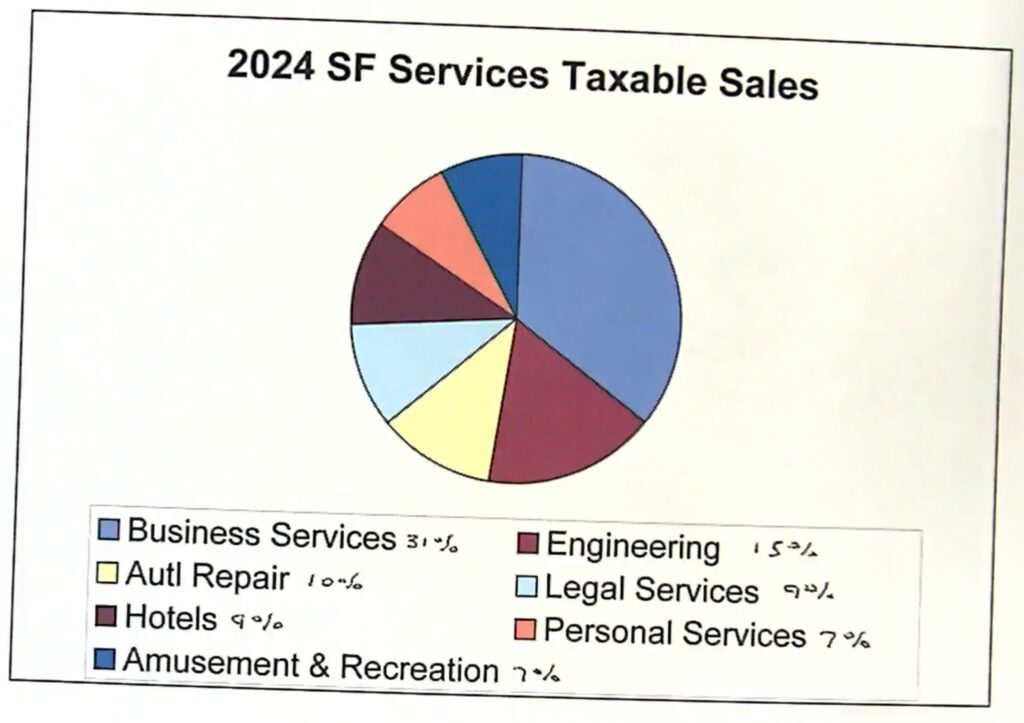

While there was a lot of bad news in both Fireball’s report and Weber’s report, the part that shocked me was when Weber said that retail sales tax growth has been flat for the last 7 months and some sectors are negative in Sioux Falls. So where does the 2% growth come from? Internet sales. If it were not for them we would have negative sales tax growth right now. You almost have to thank god we have a diversification of services in Sioux Falls to prop up our sales tax collection. I have often thought sales taxes and tariffs are regressive and we should tax income only because of the volatility of the tax and no guarantees or expectations. Or better yet, start taxing advertising.

Weber said he hasn’t seen this kind of negative sales tax growth for this long in Sioux Falls.

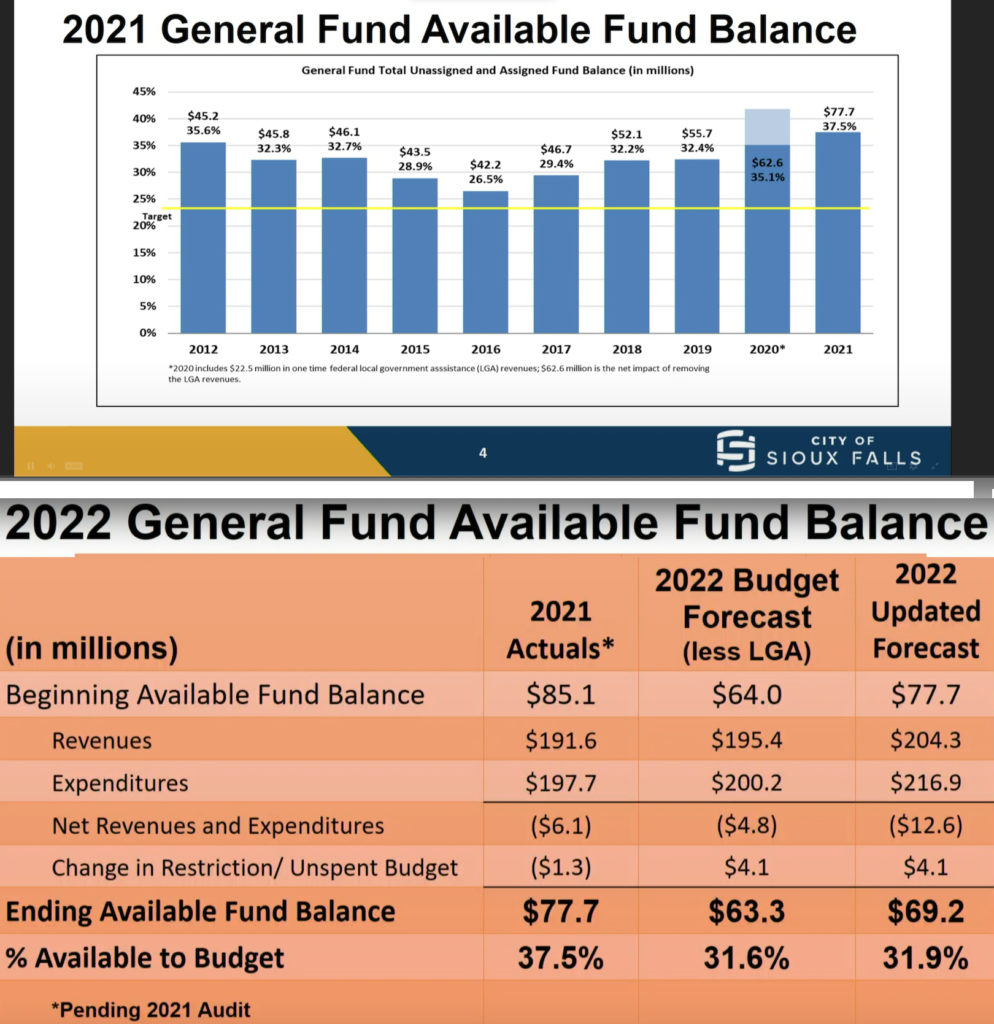

Here are some screenshots of Weber’s report;