So are the county’s tax valuations accurate and fair?

Interesting that we were just talking about this the other day on the blog, and our ever increasing property taxes. But this puts a new twist on it;

A lawsuit rising from a disputed property tax assessment involving Minnehaha County could set a troublesome precedent, county officials say.

Hutchinson Technology is suing the county, claiming the sale of a 300,000-square foot building to Sanford Health in 2009 showed the county greatly overvalued the building for tax purposes. The site at 2301 E. 60th St. had been the Hutchinson Technology campus. Sanford acquired it to be its research headquarters.

The most recent assessed valuation before the sale was $18.6 million. But Hutchinson Technology sold the site to Sanford for $12 million. Now Hutchinson Technology is challenging tax assessments from as far back as 2005 and possibly to 2001, according to Kersten Kappmeyer, Minnehaha County state’s attorney chief civil deputy.

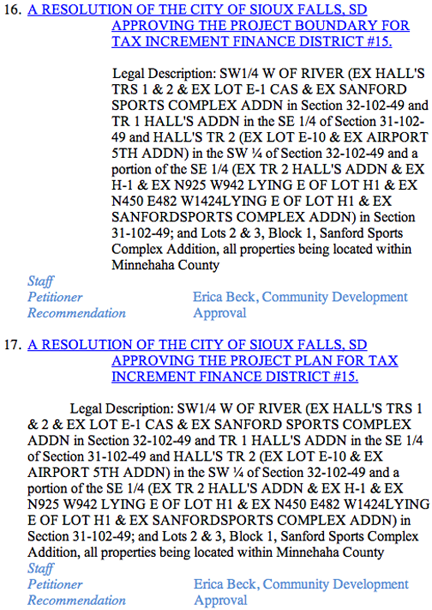

Make no mistake, I have often thought state and local governments are greedy when it comes to taxing individuals, nickel and diming us on higher utility rates and fees. Continuing opt-outs for crime prevention and punishment (when changing state laws for non-violent drug offenders would fix the problem) while handing out TIF’s to the big boys and not taxing profits of corporations.

If the County loses this lawsuit, the ripple affect could be devastating, for their coffers anyway.