City of Sioux Falls calls property tax increase ‘inflationary adjustment’

You gotta love our new found transparency with the annotated agenda and this explanation for a property tax increase (Item #59);

Background & Objective: The ordinance appropriates the tax-supported funds as part of the 2023 budget in the amount of $384,337,184 and establishes property tax revenues to be collected including the 3% inflationary adjustment as provided in South Dakota State Statute.

Even though it says right in the title of the agenda ‘INCREASE’ they explain it as an adjustment.

With inflation thru the roof and property values skyrocketing over the past year, this would be a fine time to actually CUT the property tax by 3% instead. I am hoping at least one councilor has the backbone to bring an amendment on the second reading.

Sioux Falls Citizen Mike Zitterich says it best in an email sent to council;

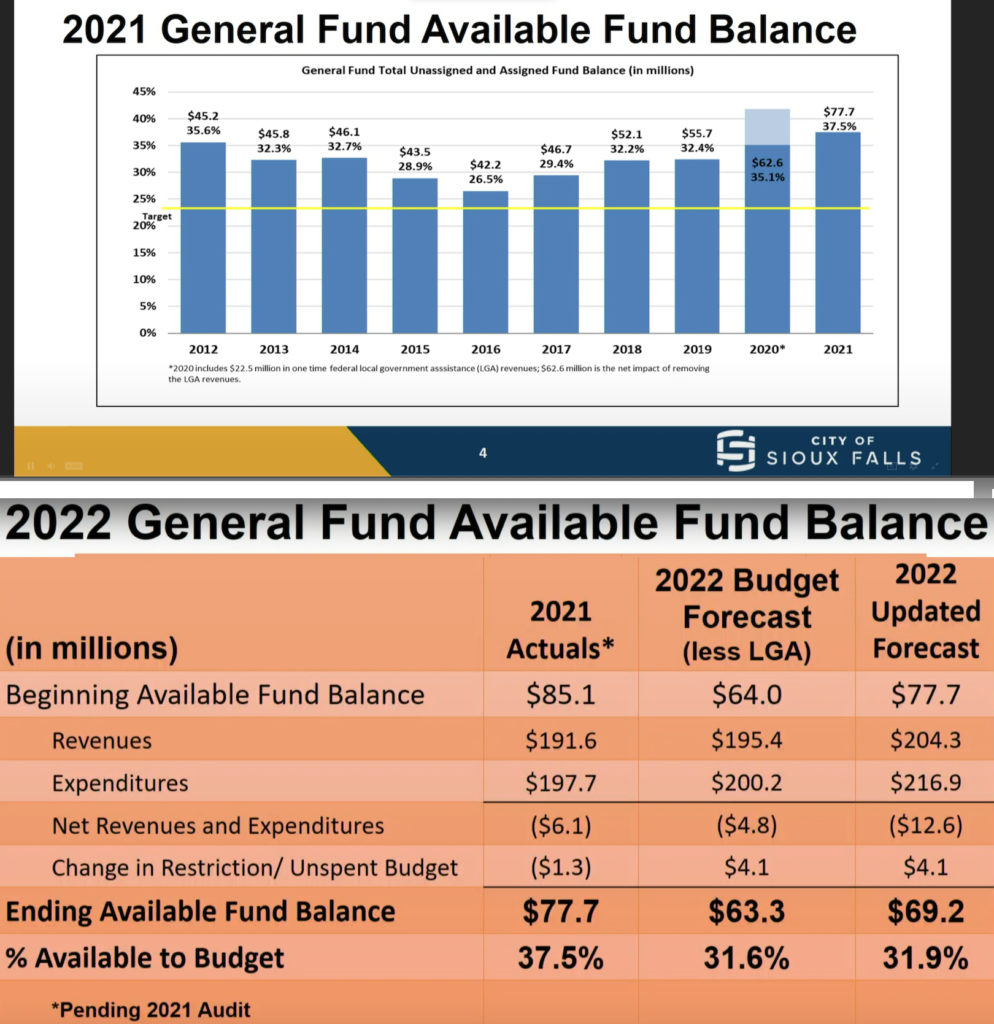

As we begin the final preparations to approve the 2023 Fiscal Budget over the next coming weeks, let’s remember, we are currently in a recession of which many Americans are struggling to put gas in their car, food on the table, pay rents, let alone survive. We can debate all day long whether we have a good or bad economy, based on the # of building permits, or tax dollars coming into the treasury, but let’s stop and remember, the city is very fortunate to be in a position it is in, where its effective tax revenues have remained consistently at or above previous levels. Lets also remember, just cause our direct property based taxes – Sales Tax on goods and services, and Property Tax assessed to the value of land are all based on the direct assessment of how much ‘income’ the residents of the city have, and if their incomes are restricted, then the city has some decisions to make. I have often called attention to the formality of the City Spending more than the actual state and local tax dollars received, while we have a tax base of nearly $400,000,000 million dollars, this city council body is approving a spending budget of nearly $700,000,000 million dollars. As I have done over the past 3 years, I have made the people aware of this huge deficit in public spending, in hopes to help educate the residents. That is essentially what we have here, a “Spending Deficit“

As for Agenda Item #59 – the Property Tax Assessments, there is no law that says we can or not increase the amount the ‘government’ is begging for, YOU GUYS have the lawful ability to apportion LESS, thus cutting the budget by a specific dollar amount.

The city really needs to move towards ZERO based budgeting each year to get the spending under control, but that would require the city council to actually do their jobs. You will notice that this week’s agenda has 67 items in which the mayor sponsors almost every single one besides private applicants. There are ZERO items sponsored by our legislative and policy body. I have argued that the mayor should have to get at least one councilor to co-sponsor his items.